Injuries On The Road – What Happens?

I was 22 when I fractured my clavicle into pieces. I swear I heard the crunch as my shoulder hit the ground from what seemed like an ordinary tumble from a horse. “No way did I just break a bone,” I thought, but the complete inability to move my right arm said otherwise. After a trip to the ER and an x-ray, my suspicions were confirmed… surgery was imminent. This already stressful scenario was made worse by the fact that I was in Los Angeles, far away from my home state of Virginia when I suffered the accident, and far away from my health insurance “home base.”

I Have Health Insurance…I’m Covered, Right?

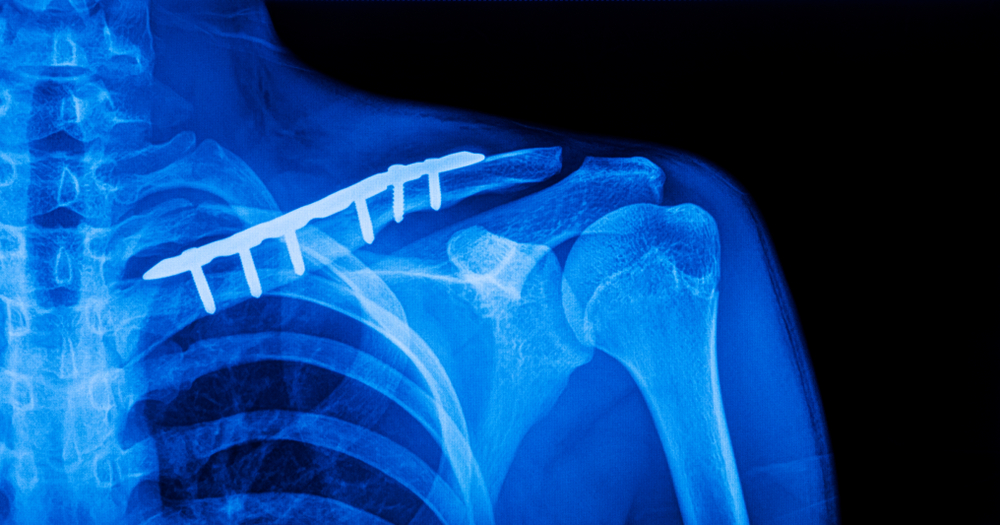

“I have health insurance,’’ “this type of event is what I’m paying my monthly premiums for,” and “this is definitely considered an emergency scenario!,” were some of the thoughts that ran through my head in the forthcoming days as I booked, and went through with my surgery. Four weeks, one titanium plate, and eight screws later I was back in Virginia on a horse. No sweat off my back! So, I thought.

A month later the medical bills started pouring in. Because I was on an ACA plan and out of my HMO’s service network, barely any of the costs of my medical expenses had been covered. I was thousands of dollars in medical debt, and completely caught off guard. I thought that was what my insurance was for? If I had known that the surgery would have cost me that much, I would have tried to negotiate a price prior to the procedure, or found somewhere else to go. This was complete financial devastation for me at the time.

I was thousands of dollars in medical debt, and completely caught off guard by it. I thought that was what my insurance was for?

Health Insurance Just For RVers

Nearly a decade later, I am a licensed health insurance agent working with RVer Insurance Exchange, offering insurance that is by RVers, for RVers…and other folks who travel. My health insurance nightmare in my early twenties stirred a passion in me for helping others avoid similar experiences, and trying to educate clients on what their insurance benefits are so that they can maximize them and take control of their own healthcare. The RVer Insurance Exchange puts agents like me into contact with a multitude of people who are all living a vulnerable lifestyle when it comes to health insurance.

Power To The Patient, or Not?

Health care costs continue to skyrocket. This year the federal government attempted to improve the situation by passing a bill to eliminate balance billing or “surprise billing” by passing the No Surprises Act, but in reality, it only created terrifying coverage limitations for people who travel, like RVers.

Conclusion

At RVer Insurance Exchange we are making a stand to try and educate consumers and align them with the best fitting insurance products for their specific needs and lifestyle. We (and our nationwide PPO health insurance plans) advocate for transparency in health insurance costs! The team at RVIE will continue to work hard to help our fellow adventurers and travelers maintain peace of mind and rest assured that they have the coverage they need, wherever the road may take them!