Turning 65, or retiring after 65?

- Independent

- Reliable

- Trusted

If you are turning 65 or retiring after the age of 65, then Medicare Supplemental Insurance could help you make the leap to full-time RVing.

For many RVers, health insurance plays a significant part in considering the RV lifestyle. Some might even say it’s the #1 obstacle to overcome before hitting the road full-time.

Those that are eligible for Medicare are also eligible for a Medicare Supplemental Plan that helps fill the gaps in coverage that Medicare leaves open. This coverage is often called Medigap insurance.

If your health care expectations are reasonable and your risks are properly managed, you can enjoy RVing and still have sufficient health coverage.

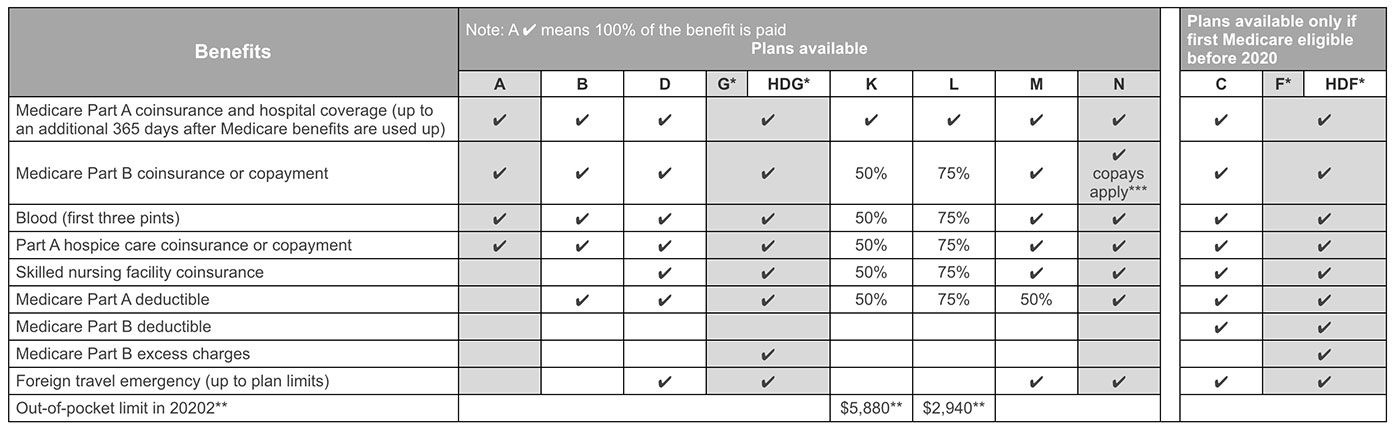

Outline of Medicare Supplement Coverage – Benefit Plans A, F, G, and N

* Plans F and G also have a high-deductible option which requires first paying a plan deductible of $2,340 before the plan begins to pay. Once the plan deductible is met, the plan pays 100% of covered services for the rest of the calendar year. High-deductible Plan G does not cover the Medicare Part B deductible. However, high-deductible Plans F and G count your payment of the Medicare Part B deductible toward meeting the plan deductible. These expenses include the Medicare deductibles for Part A and Part B, but do not include the Plan’s separate foreign travel emergency deductible.

** Plans K and L pay 100% of covered services for the rest of the calendar year once you meet the out-of-pocket yearly limit.

*** Plan N pays 100% of the Part B coinsurance except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that do not result in an inpatient admission.

Let us find the perfect Medicare Supplement plan for you:

Start your free Medicare Supplemental Insurance quote

Affordability

Health insurance is risk management. When you purchase insurance you are transferring risk from you to the insurance company. The more risk you transfer to the insurance company, then the more expensive that transfer will be. So, in order to make that transfer more affordable it’s important to not look at insurance as replacing all medical expenses. Instead of looking at health insurance as a “healthcare payment plan”, try looking at it as “asset protection”. Don’t buy insurance to help pay for every little healthcare need in your life. Can you imagine how much car insurance would cost if it covered every routine oil change, tire change, tune up, etc.?

Protect Your Family

Buy medicare supplemental insurance to protect your family from serious financial disruption should a significant healthcare need arise (i.e. major surgery, lengthy hospital stays, disability, etc.). Here are some important ways to make health insurance more affordable:

- Assume some risk: Having even a small deductible, coinsurance, and/or copayment can go a long way in helping to reduce your premiums. Thankfully for Medicare enrollees there is not a whole lot of risk involved.

- Comparison shop: Since Medicare supplement plans are standardized and easily identifiable by the letters A-N it is easy to comparison shop. Just a little “leg work” can yield significant savings with Medicare plans.

Medicare Part D (Prescriptions)

Remember when you read the word Part with a letter behind it know the Federal Government is involved. Part D became law January 1, 2006 and is a mandatory enrollment for all Medicare Beneficiaries. If you do not enroll in the allotted timeframe you will be penalized one percent per month based on the average cost of a Part D plan once you enroll. It is very important not to ignore your enrollment period because once it is over you only can enroll during the Medicare Part D and C annual enrollment period which is October 15th until December 7th each year.

Review Annually

Secondly annual review of your Part D is extremely important. You should never enroll in a plan and let it roll over to the new year. This review is as important as doing your taxes and should be on your calendar for October 1st every year.

Our agents can help explain the Part D steps to you.

UPDATE October 2019: Medicare.gov has redesigned their Medicare Plan Finder. If you plan to visit Medicare.gov please understand that it is NOT a useful resource to shop for a Medicare Supplement (Medigap) plan because their data is not accurate and not complete. It is, however, very useful for shopping for a Medicare Part D plan. They have a lengthy (37 min) How-To video for shopping for a Part D drug plan here on YouTube.

Our recommendations for RVers on Medicare

Medicare Supplemental Insurance – The Last Step

For a lot of “want-to-be” full-time RVers, getting that Medicare card in the mail is the last piece of the puzzle before hitting the road. If you are on Medicare then you arguably have the most affordable and portable health insurance available to anyone in the country.

The good news is that the vast majority of healthcare providers in the country still accept Original Medicare. Our general recommendation is to keep your very portable Original Medicare and purchase a Medicare supplement plan to fill in the gaps. Medicare Supplement plans, just like Original Medicare, will go with you wherever you go.

Who’s card do you want to carry?

So, which Medicare Supplement plan is best? Remember, Medicare Supplement plans are standardized by the federal government. This makes it a little easier to shop for the right plan because all plans of the same letter have to cover the exact same things. So, a Plan G offered by “Insurance Company A” has to be identical in benefits to the Plan G offered by “Insurance Company B”.

It comes down to who’s card do you want to carry and who do you want to do business with? Our RV insurance experts will help you make that decision. Ask for a free quote today.

If you’re willing to share some minimal costs for a lower premium…

Plan G: You only risk paying the $185 annual deductible. Premiums range from $99-$220/mo.

A great option for Medicare Supplemental Insurance is Plan G. It’s the most complete supplemental plan still available. It’s more comprehensive than Plan A, and covers the Medicare Part B excess charges that Plan N does not cover.

With Plan G, you pay your annual Medicare Part B deductible ($185 in 2019) on your own if used, saving on your monthly premium. It might be worth the risk of having to pay a small annual deductible that usually amounts to less then your annualized savings.

Plan N: You risk paying $185 annual deductible and some small co-pays, premiums about $90-$140/mo.

Plan N covers just about all of your Medicare co-insurance and deductibles except 3 small items:

- Your Medicare Part B annual deductible ($185 in 2019)

- A $20 co-pay for office visits

- A $50 co-pay for Emergency Room visits (waived if you are admitted to the hospital)

If you are willing to assume the risk for these few items, then we suggest giving Plan N a serious look. The premium savings over a Plan G can be substantial.

***Plan N has a $20 office visit copay + $50 ER copay

How to choose an insurance company

Which company you purchase your plan of choice from is really not that important from a portability standpoint. They all are accepted at the same places. Your Medicare supplemental coverage follows you wherever you go in the USA.

However, some companies will have lower rates than others for the exact same plans, and it can vary state by state. Our agents will help you compare the rates for all of the plans you might be interested in before deciding which one to go with, as well as choosing a carrier that is well established in the market. Our RV insurance specialists are RVers themselves and know what is best for you.

You can also review the insurance company’s AM BEST rating. This rating is a reflection of the company’s financial strength only. It has nothing to do with a company’s customer service or claims paying history. It may not be necessary to go with an A+ rated company since federal law protects you if your insurance company goes out of business. However, all things being equal it’s better to choose the higher-rated company.

Finally, remember these key points about Medicare supplement plans:

- They are guaranteed renewable each year

- Your coverage travels with you in all 50 states

- They are accepted everywhere Medicare is accepted

- They provide freedom to choose own doctors

- No referrals required