Insurance for your RV

Get the Best Insurance for Your RV

Get a free RV insurance quote and save up to 35%* in under 60 seconds.

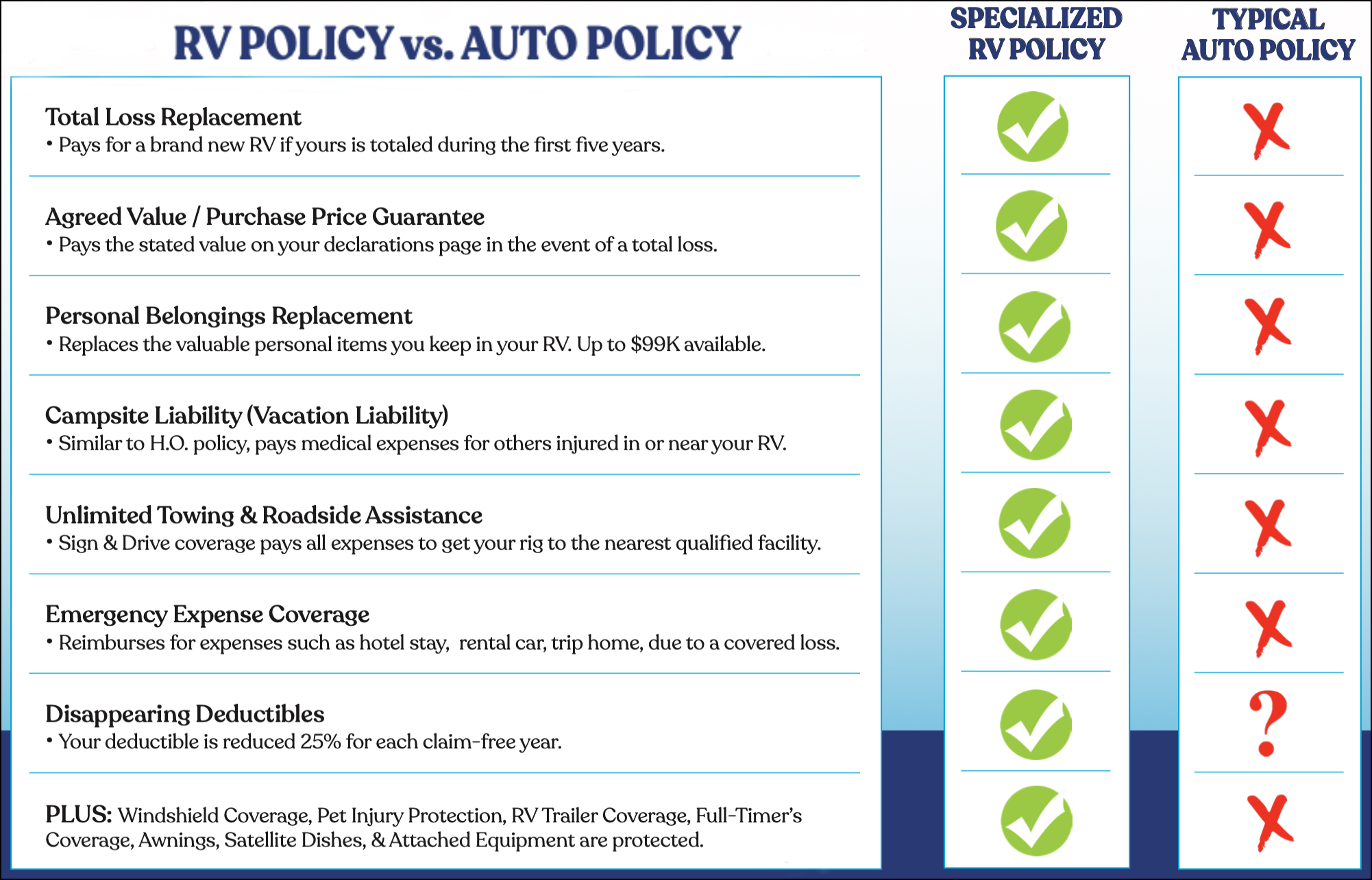

We’re RV owners, too. That’s why our tailored insurance products reflect your actual RV usage. Better coverage when you need it, lower prices when you don’t. Using market data and years of RV experience, we craft the most comprehensive plan you need, without the expensive features you don’t.